TAX TIME ROUNDUP

Tax Services & Financial Advice from NYFA Source

Every artist’s favorite time of year – time to dig up those receipts, pull up those spreadsheets, assemble those forms, and get those taxes done. Whether you sold a work of art, received grant money, collected donations through a fiscal sponsor, or ran a crowdfunding campaign, taxes on your arts income may be more complicated than the average taxpayer’s return. Plan ahead this season with this roundup of tax preparation and financial resources from NYFA Source.

FREE TAX PREP ASSISTANCE

You probably already know that taxpayers with qualifying incomes can file online for free. You might not already know about these options for free in-person tax preparation assistance:

Volunteer Income Tax Assistance (VITA) & AARP Tax Counseling for the Elderly (TCE)

Free tax help for taxpayers who qualify, based on factors such as age or income. There are thousands of VITA sites located across the country.

Tax Assistance at the New York Public Library

In addition to offering VITA and TCE at some locations, many local library branches provide paper forms and computer access and assistance for free e-filing, based on income.

Volunteer Income Tax Assistance (VITA) offers free tax help for members of Equity and SAG-AFTRA through the Actors Fund in Los Angeles and through SAG-AFTRA in New York City.

FINDING AN ACCOUNTANT

We get inquiries about this all the time. NYFA does not have a list of endorsed tax preparers who specialize in working with artists. Instead, we always recommend that artists ask colleagues for referrals – make use of the hivemind! You want to find an accountant who is familiar with the idiosyncrasies of your financial situation, so asking your peers for suggestions should be your first step.

IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications

The IRS doesn’t rate or recommend tax preparers, but they do host a directory that allows you to search for nearby accountants with certain credentials.

American Institute of Certified Public Accountants (AICPA) – State Referral Sites

Each state listed here has its own society of CPAs, and many offer a referral service that allows you to search for accountants by location, services offered, and specialty industry, such as Arts/Entertainment.

Accountants for the Arts

There are a few local organizations that provide referrals for pro bono accounting services for qualifying artists:

- Kansas City Volunteer Lawyers & Accountants for the Arts (MO)

- St. Louis Volunteer Lawyers and Accountants for the Arts (MO)

- Texas Accountants & Lawyers for the Arts (TX)

NYFA does not endorse the services posted on NYFA Classifieds, but you may find accounting services geared towards artists on our Opportunities & Services page. Click the “Services for Artists” checkbox to narrow your results.

ONLINE TAX INFO FOR ARTISTS

You can read about taxes online for days and days, but you probably don’t want to. Here are some of our favorite resources for information.

IRS Self-Employed Individuals Tax Center

Tips, tools, and forms for the self-employed. (If you earn 1099-MISCs for your work, this includes you!)

Small Business Administration: Filing & Paying Taxes

More tax advice from the government.

NYFA: An Overview of Accounting and Tax Law for Artists (Video)

This panel discussion with tax experts Elissa G. Cogan and Marcus Strock was recorded a few years ago, but is still extremely useful.

New York Academy of Art: Taxes & Bookkeeping for Artists (Video)

Tax expert Steven Goldglit’s talk on good accounting habits for artists.

Freelancer’s Union: Money & Taxes Articles for Freelancers

This is the motherload – lots and lots of tax advice for freelancers.

Fresh Arts is a great arts service nonprofit in Houston, TX, and they’ve gathered together a number of useful tax resources here, including these handy handouts:

https://www.fresharts.org/sites/default/files/Tax%20Tips%20for%20Artists.pdf

Artists from Abroad: Tax Requirements

A guide to tax requirements for artists from abroad who earn taxable income in the United States.

FREE FINANCIAL COUNSELING

Reflecting on last year’s taxes might get you thinking about the bigger financial picture. Many cities offer financial empowerment programs that are free or low-cost for qualifying residents – programs include one-on-one financial counseling, banking assistance, money education workshops, housing support, benefits referrals, and more.

Chicago, IL – Center for Economic Progress

Free tax help and financial counseling.

Cleveland, OH – Empowering and Strengthening Ohio’s People (ESOP)

VITA services and financial literacy programs.

Delaware – Delaware Financial Empowerment Partnership (DFEP) – $tand By Me®

Free one-on-one financial coaching for Delaware residents.

Denver, CO – Denver Financial Empowerment Center

Free one-on-one financial counseling, as well as online resources through Mpowered.

Hartford, CT – The Village – Family Financial Stability Initiative

Free one-on-one financial coaching for Hartford residents who meet income eligibility.

Honolulu, HI – University of Hawaii – Cooperative Extension Service

Free financial education resources online, as well as county centers with in-person programs.

Lansing, MI – Financial Empowerment Centers

Free financial counseling and online resources.

Louisville, KY – Community Services Financial Resources

Free financial, legal, and health care counseling, as well as financial education workshops and tax preparation assistance.

Miami, FL – Financial Empowerment Center (FEC) Coaching

Free long-term financial counseling for Miami residents.

Nashville, TN – Nashville Financial Empowerment Center

Free financial counseling for Davidson County residents.

New York, NY – Center for Financial Empowerment

Free one-on-one financial counseling for qualifying New Yorkers, as well as plentiful online financial advice.

Philadelphia, PA – Financial Empowerment Center

Free one-on-one financial counseling for Philadelphia residents.

Providence, RI – Financial Opportunity Centers

Free financial counseling and tax preparation.

San Antonio, TX – Financial Empowerment Center

Free one-on-one financial counseling for residents, regardless of income.

San Francisco, CA – Office of Financial Empowerment

A network of financial resources for residents of San Francisco County, including free credit counseling, small dollar emergency loans, homebuyer programs, and banking support.

Savannah, GA – Step Up Savannah

Free tax preparation, financial education, and referrals.

St. Louis, MO – Office of the Treasurer

Income tax preparation assistance, financial workshops, and an annual resource fair.

Seattle, WA – Financial Empowerment Network l Seattle-King County

Financial counseling through financial empowerment centers, as well as tax preparation assistance, and initiatives for banking and housing.

Southern California – Virtual Counselor Network

An online portal for free financial counseling and referrals to nonprofit assistance.

Just can’t get enough? You can find more tax resources on NYFA Source by clicking on the Services tab and selecting Business/Legal/Finance from the dropdown menu. Like most of these sites, we have to warn you that none of this information constitutes official professional advice. When in doubt, ask an accountant or lawyer!

– Lisa Szolovits, Researcher, Artist Resources

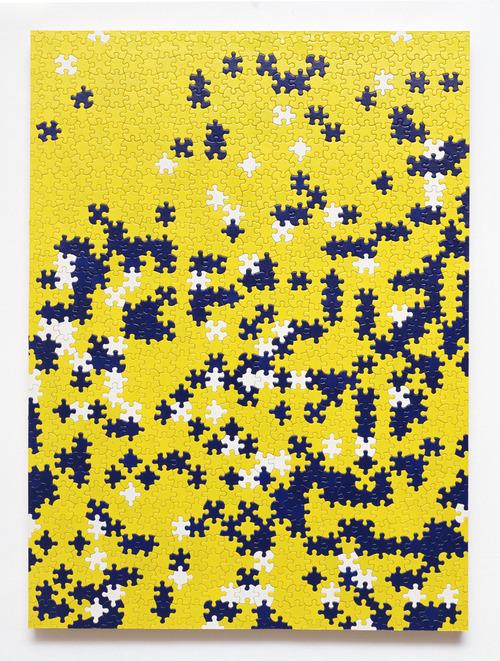

Image: Louis Cameron (Two-time Fellow in Painting ‘06/’12), GE Standard, 2004.